Understanding Petroleum Industry Upstream Dynamics & Future Trends

$5500.00

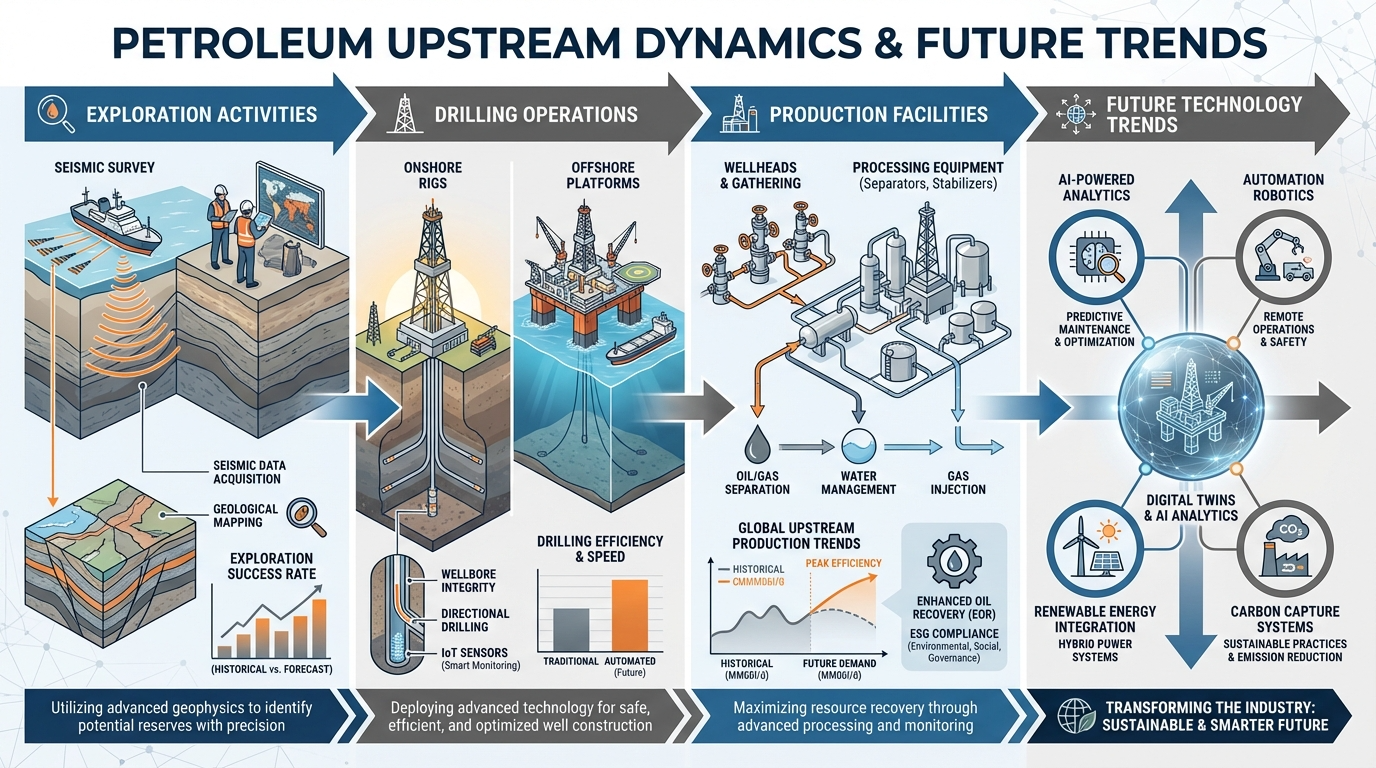

Understanding Petroleum Industry Upstream Dynamics & Future Trends: 5-Day Professional Training Course

Course Overview

This strategic 5-day training program provides comprehensive insights into upstream petroleum industry dynamics, business models, market forces, and transformative trends shaping the future of oil and gas. Designed for professionals in the Kingdom of Saudi Arabia (KSA), Oman, GCC countries, and Africa, this course covers industry value chains, geopolitics, energy transition, digital transformation, and emerging technologies essential for strategic decision-making in rapidly evolving energy markets.

Target Audience

Senior management and executives in oil and gas companies

Strategic planners and business development professionals

Investment analysts and financial advisors in energy sector

Government officials from petroleum ministries and regulatory bodies

Portfolio managers and asset strategists

Technical professionals transitioning to commercial roles

Consultants and advisors to petroleum industry

Graduate professionals seeking upstream industry knowledge

Non-technical professionals requiring industry understanding

Day 1: Upstream Petroleum Industry Fundamentals and Value Chain

Morning Session: Industry Structure and Economics

Module 1.1: Global Upstream Industry Overview

Petroleum industry evolution and historical perspective

Upstream, midstream, and downstream integration

National Oil Companies (NOCs) vs. International Oil Companies (IOCs)

Independent operators and service company ecosystem

Industry consolidation trends and mega-mergers

Regional players: Saudi Aramco, PDO, ADNOC, African NOCs

Super-majors: ExxonMobil, Shell, BP, Chevron, TotalEnergies

Private equity and new entrants in upstream sector

Module 1.2: Upstream Value Chain and Business Models

Exploration: seismic surveys, drilling, and appraisal

Development: field development planning and infrastructure

Production: operations and optimization strategies

Decommissioning: abandonment and environmental restoration

Value drivers across the upstream lifecycle

Risk-return profiles at different stages

Capital allocation and investment decisions

Portfolio management and asset optimization

Afternoon Session: Global and Regional Market Dynamics

Module 1.3: Oil and Gas Market Fundamentals

Supply and demand dynamics

Crude oil pricing mechanisms: Brent, WTI, Dubai benchmarks

Natural gas pricing: hub-based vs. oil-indexed

OPEC+ production management and market influence

Inventory levels and strategic petroleum reserves

Geopolitical factors affecting supply

Saudi Arabia’s swing producer role

African oil producers and market positioning

Module 1.4: Regional Upstream Landscape

Saudi Arabia: Aramco’s dominance, unconventional resources, Vision 2030

Oman: Mature field management, gas development, economic diversification

UAE: ADNOC expansion, offshore developments, NOC transformation

Qatar: North Field expansion, LNG leadership position

Kuwait: Heavy oil challenges, Project Kuwait initiatives

Africa: Nigeria, Angola, Egypt, Mozambique, Ghana, Senegal opportunities

Emerging exploration frontiers in Middle East and Africa

Cross-border cooperation and regional integration

Day 2: Fiscal Systems, Investment Economics, and Risk Management

Morning Session: Petroleum Fiscal Regimes

Module 2.1: Fiscal Systems Comparison

Concession agreements and royalty/tax systems

Production Sharing Contracts (PSCs) variations

Service contracts and risk service agreements

Government take analysis and competitiveness

Fiscal terms in KSA, Oman, GCC countries

African fiscal regimes: Nigeria, Angola, Egypt, Ghana

Impact of fiscal terms on investment decisions

Fiscal stability and contract sanctity

Module 2.2: Upstream Investment Economics

Capital expenditure (CAPEX) and operating expenditure (OPEX)

Economic indicators: NPV, IRR, payback period

Breakeven analysis and project screening

Cost of capital and weighted average cost of capital (WACC)

Project financing structures and funding sources

Economic modeling and sensitivity analysis

Marginal field economics in Africa

Stranded asset risks and mitigation strategies

Afternoon Session: Risk Management and Portfolio Strategy

Module 2.3: Upstream Risk Analysis

Geological and technical risks

Commercial risks: price volatility, market access

Political and regulatory risks

Environmental, social, and governance (ESG) risks

Operational and execution risks

Currency and financial risks

Risk mitigation strategies and insurance

Sovereign risk assessment in African operations

Module 2.4: Portfolio Management Strategies

Portfolio optimization frameworks

Asset maturity and lifecycle management

Diversification strategies: geographic, resource type

High-grading and divestment decisions

Mergers, acquisitions, and farm-in/farm-out transactions

Capital discipline and value creation

Portfolio rebalancing for energy transition

Case studies: Saudi Aramco, ADNOC strategic portfolios

Day 3: Technology Innovation and Digital Transformation

Morning Session: Technological Advances in Upstream

Module 3.1: Exploration and Production Technologies

Advanced seismic imaging: full waveform inversion, 4D seismic

High-performance computing and supercomputing applications

Extended reach drilling (ERD) and complex well trajectories

Enhanced oil recovery (EOR) technology advancements

Subsea technologies and deepwater innovations

Unconventional resources: hydraulic fracturing, horizontal drilling

Artificial lift optimization technologies

Nanotechnology applications in upstream

Module 3.2: Digitalization and Industry 4.0

Digital oilfield concepts and implementation

Internet of Things (IoT) and sensor networks

Real-time monitoring and remote operations centers

Predictive maintenance and asset integrity management

Cloud computing and edge computing applications

Cybersecurity challenges and solutions

Digital workforce and skills transformation

Saudi Aramco’s digital transformation journey

Afternoon Session: Data Analytics and Artificial Intelligence

Module 3.3: Big Data and Analytics

Data management and integration platforms

Advanced analytics for exploration and production

Reservoir characterization using machine learning

Production optimization algorithms

Drilling automation and autonomous operations

Supply chain optimization through analytics

Data governance and quality management

ADNOC’s Panorama digital platform

Module 3.4: Artificial Intelligence and Machine Learning

AI applications across upstream value chain

Predictive modeling for reservoir performance

Computer vision for seismic interpretation

Natural language processing for unstructured data

Digital twins and virtual asset modeling

Robotics and autonomous inspection systems

Decision support systems powered by AI

Ethical considerations and human-AI collaboration

Day 4: Energy Transition and Sustainability

Morning Session: Climate Change and Industry Response

Module 4.1: Energy Transition Fundamentals

Paris Agreement and climate commitments

Net-zero targets and decarbonization pathways

Scope 1, 2, and 3 emissions in upstream operations

Carbon pricing mechanisms and carbon markets

Stranded asset debate and reserve valuations

Peak oil demand scenarios and forecasts

Energy security vs. environmental sustainability

Saudi Green Initiative and Middle East Green Initiative

Module 4.2: Low-Carbon Operations

Methane emissions reduction strategies

Flare reduction and gas monetization

Energy efficiency in upstream operations

Electrification of operations and renewable integration

Carbon capture, utilization, and storage (CCUS)

Nature-based solutions and carbon offsets

Oman’s carbon neutrality roadmap

African green petroleum initiatives

Afternoon Session: Diversification and New Energy

Module 4.3: Hydrogen Economy and Beyond

Blue hydrogen from natural gas with CCUS

Green hydrogen using renewable electricity

Hydrogen infrastructure and transportation

Ammonia as hydrogen carrier

Saudi Arabia’s hydrogen export ambitions

UAE’s hydrogen leadership strategy

Role of NOCs in hydrogen economy

Investment requirements and economics

Module 4.4: NOC Transformation and Diversification

Energy company evolution: from IOCs to integrated energy companies

Renewable energy investments by oil majors

Petrochemicals integration and downstream expansion

Circular carbon economy concepts

Technology venture capital and innovation hubs

Saudi Aramco’s renewable energy strategy

ADNOC’s low-carbon growth framework

PDO’s sustainability initiatives

Day 5: Future Trends and Strategic Outlook

Morning Session: Geopolitics and Market Evolution

Module 5.1: Geopolitical Trends Shaping Upstream

US shale revolution and energy independence

China’s energy security and demand outlook

India’s growing consumption and import dependency

Russia’s role in global energy markets

Middle East geopolitical dynamics and stability

African resource nationalism trends

Energy as geopolitical leverage

International sanctions and compliance

Module 5.2: Market Structure Changes

OPEC+ cohesion and production management

Non-OPEC supply growth dynamics

Shift from long-term contracts to spot markets

Gas market globalization and LNG trading

Pricing benchmark evolution

Financial markets and commodity trading

Demand destruction and substitution threats

Peak oil supply vs. peak oil demand debate

Afternoon Session: Strategic Planning and Future Scenarios

Module 5.3: Scenario Planning for Uncertainty

Scenario development methodologies

IEA, OPEC, and industry outlook comparisons

Energy transition scenarios: slow, moderate, rapid

Technology disruption scenarios

Regulatory and policy evolution scenarios

Black swan events and crisis management

Stress testing portfolios against scenarios

Strategic flexibility and optionality

Module 5.4: Future of Work and Workforce

Skills transformation in digital age

Diversity, equity, and inclusion imperatives

Generational shifts and talent retention

Remote work and distributed teams

Upskilling and reskilling programs

Cross-functional collaboration models

Leadership competencies for transformation

Attracting talent to evolving industry

Module 5.5: Investment Strategies and Value Creation

Capital allocation in uncertain environment

Balancing returns to shareholders with energy transition

ESG investing and sustainable finance

Green bonds and transition finance instruments

Private equity and alternative capital sources

Technology investments and venture portfolios

Strategic partnerships and joint ventures

Long-term value creation frameworks

Day 5 Final Session: Comprehensive Case Studies and Strategic Workshop

Module 5.6: Strategic Case Studies

Saudi Arabia - Vision 2030 and Beyond:

Aramco’s IPO and shareholder value strategy

Unconventional gas development (Jafurah)

Downstream and chemicals integration (SATORP, YASREF)

Renewable energy and NEOM city

Circular carbon economy roadmap

Technology innovation and R&D investments

Oman - Economic Diversification:

PDO’s mature field optimization

Gas development for domestic consumption and exports

In-Country Value (ICV) program impacts

Duqm refinery integration strategy

Vision 2040 and upstream role

Fiscal reforms and competitiveness

UAE - Energy Leadership:

ADNOC 2030 strategy and capacity expansion

Offshore concession models and partnerships

Downstream integration (Ruwais complex)

Hydrogen and CCUS leadership

AI and digital transformation

Attracting international investment

Africa - Unlocking Potential:

Mozambique LNG mega-projects and challenges

Nigeria’s Petroleum Industry Act reform

Angola’s IOC partnerships and new opportunities

Egypt’s Eastern Mediterranean gas discoveries

Senegal and Mauritania emerging frontiers

Energy access and local content development

Interactive Strategic Workshop

Group scenario planning exercise

Strategic positioning debate: traditional vs. energy transition

Investment prioritization simulation

Risk assessment and mitigation workshop

Future trends brainstorming session

Regional strategy presentations

Executive panel discussion

Course synthesis and action planning

Course Learning Outcomes

Participants will gain:

Comprehensive understanding of global and regional upstream dynamics

Strategic insights into petroleum economics and fiscal systems

Technology awareness of digital transformation and innovation trends

Energy transition knowledge for navigating decarbonization pressures

Geopolitical perspective on market forces and supply security

Investment frameworks for portfolio optimization and value creation

Future-ready mindset for industry evolution and disruption

Regional expertise specific to KSA, Oman, GCC, and African markets

Leadership capabilities for strategic decision-making in uncertainty

Regional Strategic Focus: KSA, Oman, GCC & Africa

Kingdom of Saudi Arabia: Vision 2030 diversification, Aramco’s transformation, unconventional resources, circular carbon economy, hydrogen economy leadership, and maintaining energy market influence.

Oman: Economic diversification beyond oil, gas monetization strategies, Vision 2040 implementation, mature field management, and fiscal sustainability.

GCC Region: Regional cooperation, capacity expansion strategies, energy security balance, downstream integration, renewable energy investments, and NOC transformation models.

Africa: Resource development opportunities, fiscal reform impacts, energy access imperatives, local content policies, political risk navigation, and emerging basin exploration.

Training Methodology

Executive-level strategic presentations

Industry expert guest speakers

Interactive case study discussions

Scenario planning workshops

Group strategy simulations

Panel debates on controversial topics

Site visits to operations centers (where available)

Networking sessions with industry leaders

Duration: 5 days (35-40 strategic learning hours)

Delivery: In-person preferred for networking, hybrid available

Language: English (Arabic translation for GCC sessions)

Materials: Comprehensive strategic briefing books and industry reports

Certification: Executive professional development certificate

Keywords: petroleum industry dynamics training, upstream oil and gas strategy KSA, energy transition course Oman, GCC petroleum economics, African upstream trends, digital oilfield transformation, NOC strategic planning, petroleum fiscal systems, energy market analysis, Saudi Aramco strategy, ADNOC transformation, PDO future outlook, upstream investment decisions, oil and gas geopolitics