Review & Comparison of Different Fiscal Systems

$5500.00

Review & Comparison of Different Fiscal Systems: 5-Day Professional Training Course

Course Overview

This specialized 5-day training program provides in-depth analysis and comparison of petroleum fiscal systems worldwide. Designed for professionals in the Kingdom of Saudi Arabia (KSA), Oman, GCC countries, and Africa, this course covers fiscal regime design, government take analysis, comparative evaluation, and optimization strategies essential for maximizing value in upstream investments across diverse regulatory environments.

Target Audience

Government officials and petroleum ministry staff

Economic analysts and fiscal policy advisors

Commercial managers and negotiators

Investment analysts and portfolio managers

Legal and tax specialists

Business development professionals

Technical professionals from Saudi Aramco, PDO, ADNOC, and African operators

Consultants advising governments and companies

Financial institutions in energy sector

Day 1: Fiscal System Fundamentals and Classification

Morning Session: Introduction to Petroleum Fiscal Systems

Module 1.1: Fiscal System Objectives and Principles

Host government objectives: revenue, control, technology transfer

Investor requirements: return on investment, risk mitigation

Balancing government and contractor interests

Fiscal neutrality and progressivity concepts

Investment attractiveness and competitiveness

Stability vs. flexibility trade-offs

Sovereignty and resource nationalism

International best practices and trends

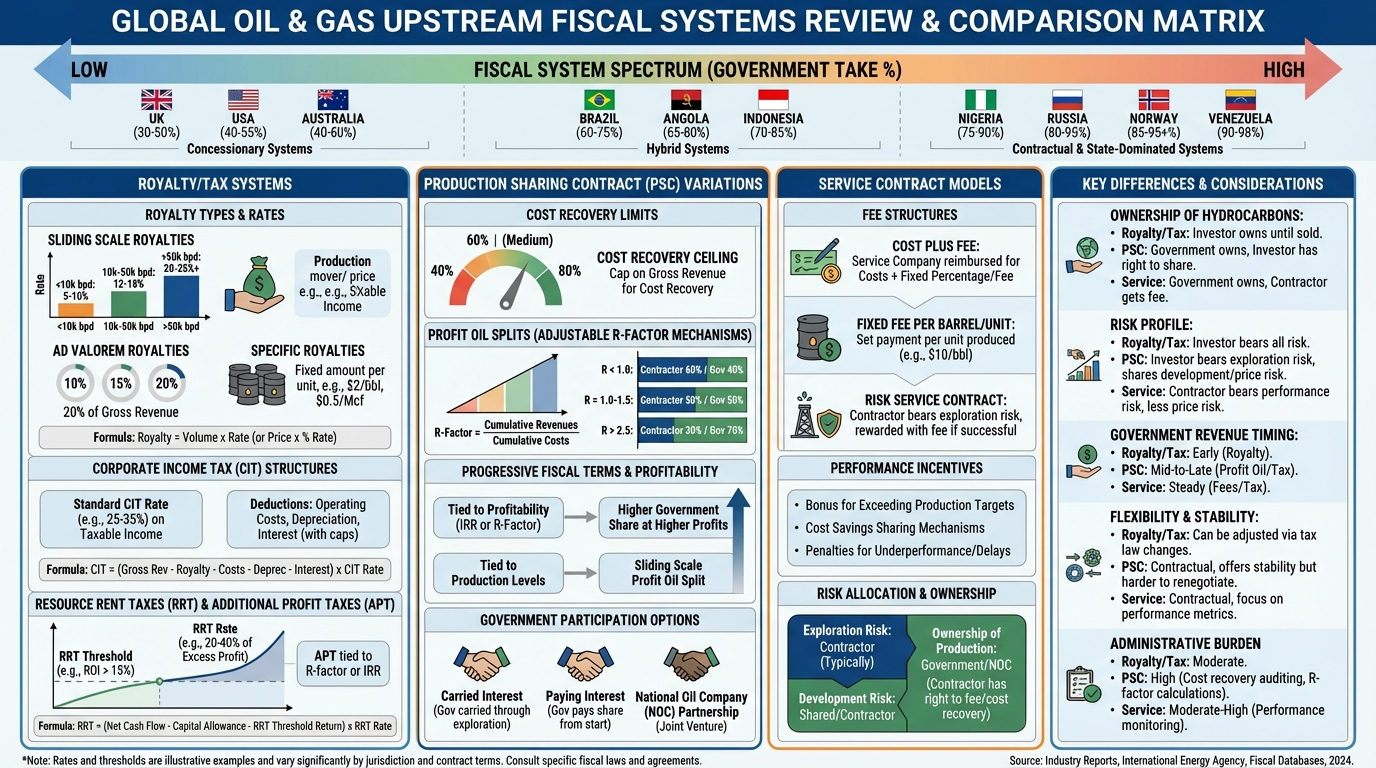

Module 1.2: Fiscal System Classification

Concessionary systems (royalty/tax)

Contractual systems (PSC, service contracts)

Hybrid and mixed systems

Production sharing vs. profit sharing

Tax/royalty vs. production sharing comparison

Evolution of fiscal systems globally

Regional fiscal system preferences

Factors influencing system selection

Afternoon Session: Key Fiscal Instruments

Module 1.3: Revenue Collection Mechanisms

Royalties: ad valorem, specific, sliding scale

Corporate income tax structures

Petroleum revenue tax and resource rent tax

Signature and production bonuses

Surface rentals and fees

Export taxes and levies

State participation mechanisms

Carried interest and back-in rights

Module 1.4: Cost Recovery and Deductions

Capital expenditure recovery mechanisms

Operating expenditure treatment

Depreciation methods: straight-line, declining balance, unit-of-production

Depletion allowances

Loss carry-forward provisions

Cost recovery limits and ceilings

Uplift and investment credits

Abandonment cost treatment

Day 2: Concessionary and Royalty/Tax Systems

Morning Session: Traditional Concession Systems

Module 2.1: Royalty Mechanisms

Fixed percentage royalties

Progressive royalty structures

Price-responsive royalties

Profit-based royalties

Production-based sliding scales

Royalty valuation points

Gross vs. net royalty systems

Regional royalty rates comparison

Module 2.2: Tax-Based Fiscal Systems

Corporate income tax rates globally

Petroleum-specific taxation

Resource rent taxation: Brown tax, PRRT

Ring-fencing and consolidation rules

Tax depreciation schedules

Thin capitalization rules

Withholding taxes

Tax holidays and incentives

Afternoon Session: Advanced Royalty/Tax Systems

Module 2.3: United States Fiscal System

Federal vs. state fiscal terms

Offshore lease bonus bidding system

Royalty rates: onshore and offshore

Gulf of Mexico fiscal framework

Alaska and Texas fiscal variations

Tight oil and shale gas fiscal incentives

Module 2.4: United Kingdom and Norway Models

UK North Sea fiscal evolution

Ring-fence corporation tax

Petroleum revenue tax (historical)

Supplementary charge mechanism

Investment allowances and reliefs

Norway’s government participation model

State Direct Financial Interest (SDFI)

Resource rent tax application

Decommissioning cost relief

Day 3: Production Sharing Contracts (PSCs)

Morning Session: PSC Structures and Variations

Module 3.1: Classic PSC Framework

Indonesian PSC model (first generation)

Cost recovery ceiling mechanisms

Fixed profit split arrangements

First Tranche Petroleum (FTP) concept

Investment credit systems

Domestic Market Obligation (DMO)

Contractor lifting entitlements

Government take calculation

Module 3.2: Modern PSC Variations

Malaysian PSC structure

Sliding scale profit sharing

R-factor (revenue/cost) based systems

Production-based sharing mechanisms

Rate of return-based sharing

Price-responsive PSC terms

Progressive vs. regressive characteristics

Hybrid PSC-concession systems

Afternoon Session: Regional PSC Comparisons

Module 3.3: Middle East and North Africa PSCs

Egypt PSC framework and evolution

Libya EPSA (Exploration and Production Sharing Agreement)

Kurdistan Region PSC terms

Oman PSC block structure

Yemen PSC characteristics

Syria and Iraq PSC variations

Fiscal competitiveness analysis

Module 3.4: Sub-Saharan Africa PSCs

Nigeria PSC and deep offshore terms

Angola PSC evolution and reforms

Ghana petroleum agreements

Mozambique PSC framework

Tanzania and Kenya PSC terms

Uganda PSC structure

Senegal and Mauritania fiscal systems

Frontier exploration incentives

Day 4: Service Contracts and Comparative Analysis

Morning Session: Service Contract Models

Module 4.1: Risk Service Contracts

Iraq Technical Service Contracts (TSCs)

Remuneration fee structures

Per-barrel payment mechanisms

Plateau production targets

Cost recovery in service contracts

R/C (remuneration fee/cost) ratios

Signature and production bonuses

Comparison with PSCs and concessions

Module 4.2: Pure Service and Management Contracts

Iran buyback contracts evolution

IPC (Iran Petroleum Contract) framework

Venezuela Empresas Mixtas model

Mexico’s migration to production sharing

Kuwait operating service agreements

Technical service agreements (TSAs)

Fixed fee vs. incentive-based remuneration

Risk allocation comparison

Afternoon Session: Government Take Analysis

Module 4.3: Government Take Calculation

Government take definition and components

Undiscounted vs. discounted government take

Effective royalty rate calculation

Marginal government take concept

Break-even analysis across systems

Sensitivity to oil prices and costs

Time profile of government revenues

International benchmarking studies

Module 4.4: Fiscal System Indicators

Average Effective Tax Rate (AETR)

Marginal Effective Tax Rate (METR)

Progressivity and regressivity measures

Contractor Internal Rate of Return (IRR)

Government IRR calculation

NPV sharing between parties

Investment hurdle rates

Comparative ranking methodologies

Day 5: Optimization and Strategic Applications

Morning Session: Fiscal System Design and Reform

Module 5.1: Designing Optimal Fiscal Systems

Balancing revenue and investment objectives

Simplicity vs. sophistication trade-offs

Administrative capacity considerations

Transparency and predictability

Incentivizing exploration and development

Marginal field fiscal provisions

Deepwater and frontier incentives

Enhanced oil recovery (EOR) fiscal benefits

Gas development fiscal frameworks

Module 5.2: Fiscal Reform Case Studies

Mexico’s 2014 energy reform

Brazil’s pre-salt fiscal regime

Angola’s fiscal modernization

Egypt’s recent PSC modifications

Ghana petroleum revenue management

Nigeria’s PIB (Petroleum Industry Bill/Act)

Uganda’s fiscal framework development

Regional reform trends and drivers

Afternoon Session: Strategic Applications

Module 5.3: Investment Decision Making

Fiscal system impact on investment economics

Portfolio optimization across jurisdictions

Bid strategy under different fiscal terms

Farm-in/farm-out valuation considerations

Economic modeling across fiscal systems

Risk-adjusted returns comparison

Political and fiscal risk assessment

Negotiation strategies for fiscal terms

Module 5.4: Emerging Trends and Special Topics

Carbon and Environmental Fiscal Measures:

Carbon taxes and pricing mechanisms

Flaring penalties and gas conservation

Environmental levies and fees

CCUS fiscal incentives

Renewable energy integration incentives

Digital Economy and Fiscal Systems:

Transfer pricing in digital services

Data ownership and taxation

Technology service taxation

Digital monitoring and compliance

Local Content and Fiscal Integration:

Local content cost implications

Fiscal credits for local procurement

Training and employment incentives

Infrastructure development obligations

Comprehensive Regional Comparison Workshop

Detailed Fiscal Regime Analysis:

Saudi Arabia:

Aramco’s fiscal relationship with government

Unconventional gas fiscal framework

Joint venture fiscal structures

Vision 2030 fiscal implications

Oman:

Block PSC fiscal terms variations

Gas pricing and fiscal implications

ICV (In-Country Value) integration

Mature vs. frontier fiscal incentives

UAE:

ADNOC concession fiscal structures

Abu Dhabi vs. other emirates

Offshore vs. onshore fiscal terms

Long-term concession economics

Kuwait:

Operating service agreement remuneration

Technical service fee structures

Cost recovery provisions

Government take benchmarking

Qatar:

North Field partnership fiscal terms

LNG project fiscal arrangements

Offshore development fiscal framework

Africa Comparative Analysis:

Nigeria: PSC vs. JV fiscal comparison

Angola: Decree 5/19 reforms impact

Egypt: concession vs. PSC economics

Ghana: petroleum fiscal stability

Mozambique: LNG project fiscal terms

East Africa: Uganda, Kenya, Tanzania comparison

West Africa: Senegal, Mauritania, Ivory Coast

Competitiveness ranking and trends

Interactive Workshop Components:

Fiscal modeling exercise across systems

Government take calculation workshop

Economic comparison under various scenarios

Investment ranking simulation

Negotiation role-play with fiscal terms

Fiscal reform design exercise

Bid evaluation using fiscal analysis

Group presentations: optimal system design

Expert panel Q&A session

Learning Outcomes

Participants will master:

Comprehensive understanding of global fiscal system types

Analytical skills for government take calculation

Comparative evaluation methodologies across jurisdictions

Economic modeling capabilities for fiscal systems

Investment decision frameworks considering fiscal terms

Negotiation strategies for fiscal provisions

Reform design principles and best practices

Regional expertise in KSA, Oman, GCC, and African fiscal regimes

Competitiveness assessment and benchmarking skills

Regional Fiscal Intelligence

Saudi Arabia: Aramco fiscal model, unconventional terms, partnership frameworks

Oman: PSC variations, gas pricing mechanisms, fiscal incentives

GCC: Comparative analysis across UAE, Qatar, Kuwait, Bahrain fiscal systems

Africa: Nigeria vs. Angola reforms, East Africa frontier terms, West Africa competitiveness

Training Methodology

Expert lectures on fiscal theory and practice

Excel-based fiscal modeling workshops

Real contract fiscal term analysis

Case studies from global jurisdictions

Interactive calculation exercises

Comparative analysis projects

Government and investor perspective debates

Fiscal software demonstrations

Duration: 5 days (40 hours)

Delivery: In-person, virtual, or hybrid

Language: English (Arabic support available)

Materials: Fiscal models, contract templates, benchmarking data

Certification: Petroleum fiscal systems expert certificate

Keywords: petroleum fiscal systems training, government take analysis KSA, PSC comparison Oman, oil and gas taxation GCC, African petroleum fiscal regimes, royalty tax systems, production sharing contracts, fiscal reform, investment economics, Saudi Aramco fiscal terms, ADNOC concession economics, PDO PSC analysis, Nigeria Angola fiscal comparison, fiscal competitiveness Middle East Africa