Petroleum Project Evaluation

$5500.00

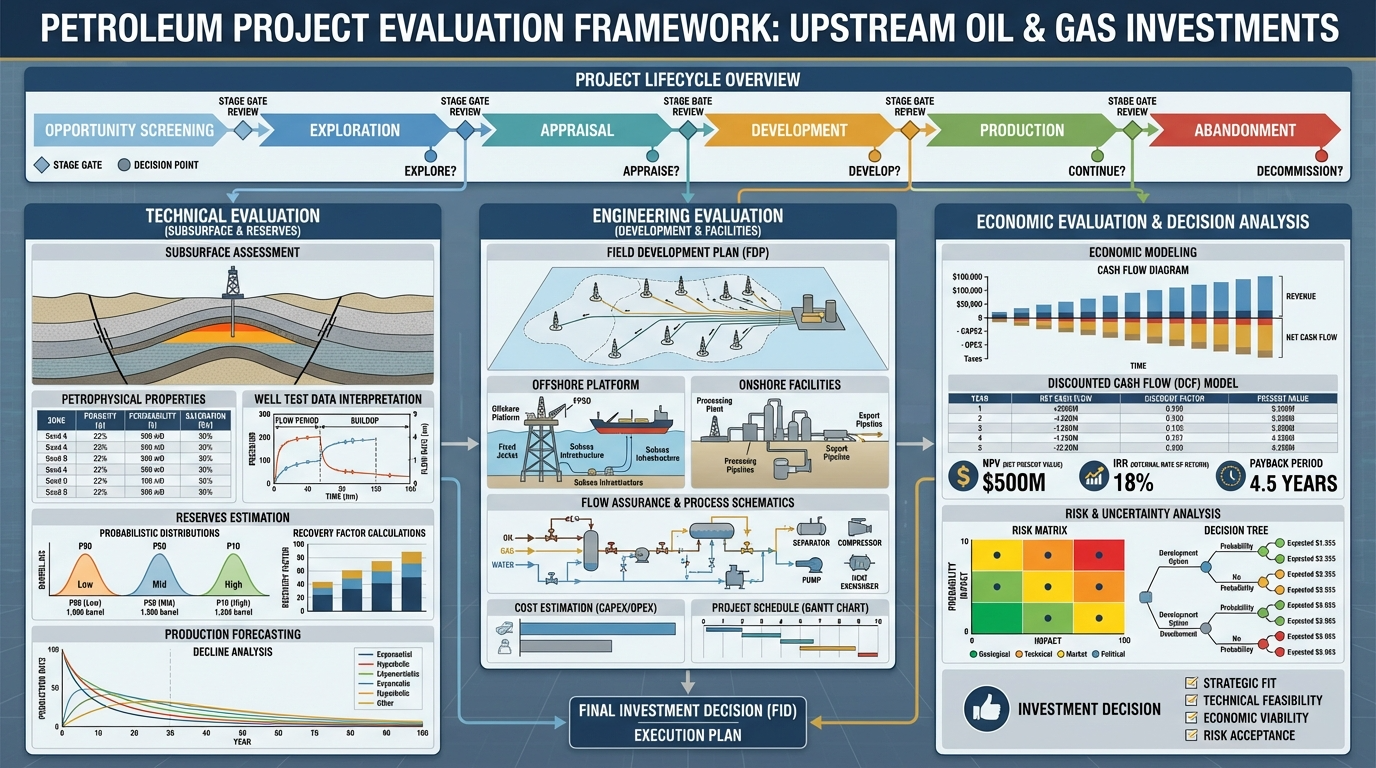

Petroleum Project Evaluation: 5-Day Professional Training Course

Course Overview

This comprehensive 5-day training program delivers essential knowledge and practical skills for evaluating petroleum projects from technical and commercial perspectives. Designed for professionals in the Kingdom of Saudi Arabia (KSA), Oman, GCC countries, and Africa, this course covers project screening, economic analysis, risk assessment, reserves valuation, and decision-making frameworks essential for optimizing upstream investments and maximizing asset value.

Target Audience

Petroleum and reservoir engineers

Project managers and development planners

Investment analysts and portfolio managers

Commercial and business development professionals

Asset managers and strategists

Financial analysts in oil and gas sector

Technical professionals from Saudi Aramco, PDO, ADNOC, and African operators

Government officials evaluating projects

Consultants and advisors

M&A specialists and due diligence teams

Day 1: Project Evaluation Fundamentals

Morning Session: Introduction to Project Evaluation

Module 1.1: Evaluation Framework

Project lifecycle: exploration to decommissioning

Evaluation objectives and decision gates

Technical vs. commercial evaluation integration

Screening, appraisal, and selection criteria

Multi-disciplinary team approach

Stage-gate decision-making process

Portfolio context and strategic fit

Regional project characteristics: Middle East vs. Africa

Module 1.2: Economic Fundamentals

Time value of money and discounting

Cash flow construction and timing

Revenue streams: oil, gas, condensate, NGLs

Capital expenditure (CAPEX) components

Operating expenditure (OPEX) elements

Working capital requirements

Abandonment and decommissioning costs

Tax and fiscal obligations

Afternoon Session: Economic Indicators

Module 1.3: Profitability Metrics

Net Present Value (NPV): calculation and interpretation

Internal Rate of Return (IRR) and Modified IRR

Profitability Index (PI) and ranking projects

Discounted Profit-to-Investment Ratio (DPIR)

Payback period: simple and discounted

Return on Investment (ROI) measures

Growth Rate of Return (GRR)

Indicator selection for decision-making

Module 1.4: Economic Limit and Optimization

Economic limit criteria

Abandonment timing decisions

Project life optimization

Production plateau optimization

Facilities sizing economics

Phased development evaluation

Incremental project analysis

Saudi Arabia field development optimization

Day 2: Reserves Evaluation and Production Forecasting

Morning Session: Reserves Classification

Module 2.1: Reserves and Resources Framework

SPE-PRMS classification system

Proved, probable, possible reserves (1P, 2P, 3P)

Contingent and prospective resources

Deterministic vs. probabilistic methods

P90, P50, P10 reserves interpretation

Commercial vs. sub-commercial classification

Reserves maturation pathway

SEC and international reporting standards

Module 2.2: Reserves Estimation Methods

Volumetric methods and uncertainty

Material balance calculations

Decline curve analysis: Arps equations

Analogy and type curve methods

Simulation-based reserves estimation

Recovery factor determination

Reserves auditing requirements

Oman and GCC reserves booking practices

Afternoon Session: Production Forecasting

Module 2.3: Production Profile Development

Reservoir deliverability analysis

Well productivity and inflow performance

Facility constraints and bottlenecks

Plateau rate determination

Decline phase forecasting

Water cut and GOR evolution

Production optimization strategies

Artificial lift requirements and timing

Module 2.4: Field Development Planning

Development concept selection

Well count and spacing optimization

Drilling schedule and phasing

Infrastructure and facilities planning

Subsea vs. platform economics

Tie-back vs. standalone development

Fast-track vs. phased development

African marginal field development strategies

Day 3: Cost Estimation and Economic Modeling

Morning Session: Cost Estimation

Module 3.1: Capital Cost Estimation

AACE cost classification: Class 5 to Class 1

Factored estimates and parametric methods

Bottom-up detailed estimates

Drilling and completion costs

Facilities and infrastructure costs

Subsea systems and pipelines

Contingency estimation methods

Cost escalation and inflation

Regional cost benchmarking: GCC vs. Africa

Module 3.2: Operating Cost Analysis

Fixed vs. variable OPEX components

Production operations costs

Maintenance and workover costs

Artificial lift operating costs

Water handling and disposal

Personnel and administration

Utilities and consumables

Cost per barrel benchmarking

OPEX reduction strategies

Afternoon Session: Economic Modeling

Module 3.3: Cash Flow Modeling

Revenue calculation and pricing assumptions

Gross revenue and royalty deductions

Cost recovery in PSC frameworks

Depreciation and amortization

Tax calculations: income, petroleum, withholding

Net cash flow after tax

Discounted cash flow analysis

Sensitivity to key variables

Module 3.4: Fiscal System Integration

Concession vs. PSC economic modeling

Government take calculation

Contractor entitlement determination

Bonus payments and timing

Domestic market obligations (DMO)

Local content cost impacts

Fiscal stability provisions

Multi-country project comparison

Day 4: Risk Analysis and Decision-Making

Morning Session: Risk and Uncertainty

Module 4.1: Risk Identification and Assessment

Technical risks: geological, drilling, production

Commercial risks: price, market, fiscal

Political and regulatory risks

Environmental and social risks

Operational and execution risks

Risk probability and impact matrices

Risk register development

Risk mitigation strategies

Module 4.2: Probabilistic Analysis

Monte Carlo simulation applications

Input distribution selection

Correlation between variables

P90, P50, P10 economic outcomes

Expected Monetary Value (EMV)

Probability of commercial success

Value at Risk (VaR) measures

Upside potential assessment

Afternoon Session: Decision Analysis

Module 4.3: Sensitivity and Scenario Analysis

One-way sensitivity analysis

Tornado diagrams for ranking variables

Spider plots and breakeven analysis

Two-way sensitivity tables

Scenario development: base, low, high

Price scenario modeling

Switching values determination

Kuwait heavy oil project sensitivities

Module 4.4: Decision Trees and Real Options

Decision tree construction

Sequential decision modeling

Value of information analysis

Real options in petroleum projects

Flexibility value quantification

Optimal timing decisions

Phasing and abandonment options

Portfolio optimization under uncertainty

Day 5: Special Topics and Practical Applications

Morning Session: Advanced Evaluation Topics

Module 5.1: Enhanced Oil Recovery Projects

EOR screening and selection

Incremental recovery estimation

EOR capital and operating costs

Pilot project evaluation

Full-field implementation economics

CO2 sourcing and costs

Polymer flooding economics: Oman examples

Saudi Uthmaniyah CO2 EOR evaluation

Module 5.2: Gas and LNG Projects

Gas project economic characteristics

Domestic vs. export gas economics

LNG value chain evaluation

Gas-to-power project assessment

Stranded gas monetization options

Gas pricing mechanisms impact

Pipeline vs. LNG economics

Qatar North Field and Mozambique LNG projects

Afternoon Session: M&A and Portfolio Management

Module 5.3: Asset Valuation and M&A

Valuation methods: DCF, comparable transactions

Proved Developed Producing (PDP) valuation

Undeveloped reserves valuation

Exploration acreage valuation

Synergies and integration costs

Due diligence evaluation process

Bid strategy and negotiation

Farm-in/farm-out economics

ADNOC and African M&A examples

Module 5.4: Portfolio Optimization

Portfolio screening criteria

Project ranking and prioritization

Capital allocation optimization

Resource constraints integration

Risk-return portfolio analysis

High-grading strategies

Divestment decision framework

Strategic vs. financial criteria

Module 5.5: Sustainability and Energy Transition

Carbon pricing impact on projects

Emissions reduction investment evaluation

Flare reduction project economics

CCS (Carbon Capture and Storage) integration

Renewable energy project evaluation

Hydrogen production economics

Circular carbon economy projects

Saudi Vision 2030 aligned investments

Comprehensive Case Studies Workshop

Regional Project Evaluations:

Saudi Arabia:

Ghawar infill drilling program evaluation

Jafurah unconventional gas development

Manifa offshore complex reservoir project

Shaybah MRC well economics

Downstream integration project assessment

Oman:

PDO mature field redevelopment

Khazzan tight gas project economics

Mukhaizna heavy oil steam flood

Block 60 exploration prospect evaluation

Polymer flooding expansion decision

UAE:

ADNOC offshore field development

Upper Zakum expansion project

Sour gas development economics

Hail and Ghasha mega-project

Concession acquisition valuation

Kuwait:

Greater Burgan horizontal well program

Heavy oil development concept selection

Thermal EOR pilot evaluation

Northern fields development

Qatar:

North Field expansion economics

Gas condensate development

LNG train addition evaluation

Offshore tie-back project

Africa:

Nigeria deepwater development: subsea-to-FPSO

Angola pre-salt exploration prospect

Egypt Western Desert field redevelopment

Ghana Jubilee Phase 2 expansion

Mozambique Area 1 LNG project

Senegal SNE field development

Uganda Lake Albert development

Tanzania offshore gas project

Interactive Workshop Exercises:

Complete project cash flow model development

Economic indicator calculations

Reserves categorization exercise

Risk-weighted project valuation

Decision tree analysis

Portfolio ranking simulation

Sensitivity analysis workshop

Comparative fiscal system modeling

Investment committee presentation role-play

Group project evaluation and peer review

Learning Outcomes

Participants will master:

Comprehensive evaluation of petroleum projects

Economic modeling and cash flow analysis

Reserves estimation and classification

Risk assessment and probabilistic methods

Decision analysis tools and frameworks

Cost estimation techniques

Fiscal system integration in evaluations

Portfolio optimization strategies

Regional expertise in KSA, Oman, GCC, and African projects

Software proficiency in evaluation tools

Regional Project Focus

Saudi Arabia: Mega-project evaluation, unconventional economics, MRC well optimization, Vision 2030 integration

Oman: Mature field economics, EOR project evaluation, tight gas development, PDO portfolio optimization

GCC: Offshore development, sour gas economics, gas monetization, concession valuations

Africa: Deepwater projects, marginal fields, frontier exploration, political risk integration, local content impacts

Training Methodology

Technical lectures with case examples

Excel-based economic modeling workshops

Evaluation software demonstrations

Real project case studies

Hands-on calculation exercises

Group evaluation projects

Investment decision simulations

Peer presentations and critiques

Duration: 5 days (40 hours)

Delivery: In-person, virtual, or hybrid

Language: English (Arabic support available)

Software: Excel models, evaluation templates

Materials: Case studies, calculation tools, reference guides

Certification: Professional project evaluation certificate

Keywords: petroleum project evaluation training, oil and gas economics KSA, project appraisal Oman, upstream investment GCC, field development economics Africa, NPV IRR calculation, reserves valuation, production forecasting, cost estimation petroleum, Saudi Aramco project analysis, ADNOC investment evaluation, PDO development planning, cash flow modeling, risk analysis upstream, portfolio optimization oil gas