Concession, Production Sharing and JV Contracts

$5500.00

Concession, Production Sharing and JV Contracts: 5-Day Professional Training Course

Course Overview

This intensive 5-day training program provides comprehensive knowledge of upstream petroleum contracts, fiscal systems, and joint venture agreements. Designed for professionals in the Kingdom of Saudi Arabia (KSA), Oman, GCC countries, and Africa, this course covers concession agreements, production sharing contracts (PSCs), joint operating agreements (JOAs), and commercial frameworks essential for successful upstream partnerships and operations.

Target Audience

Legal counsel and contract managers

Commercial analysts and negotiators

Petroleum engineers and reservoir managers

Government officials from petroleum ministries

Business development professionals

Joint venture partners and NOC/IOC representatives

Finance and tax specialists

Technical professionals from Saudi Aramco, PDO, ADNOC, and African operators

Investment analysts and asset managers

Day 1: Petroleum Contract Fundamentals

Morning Session: Contract Framework and Evolution

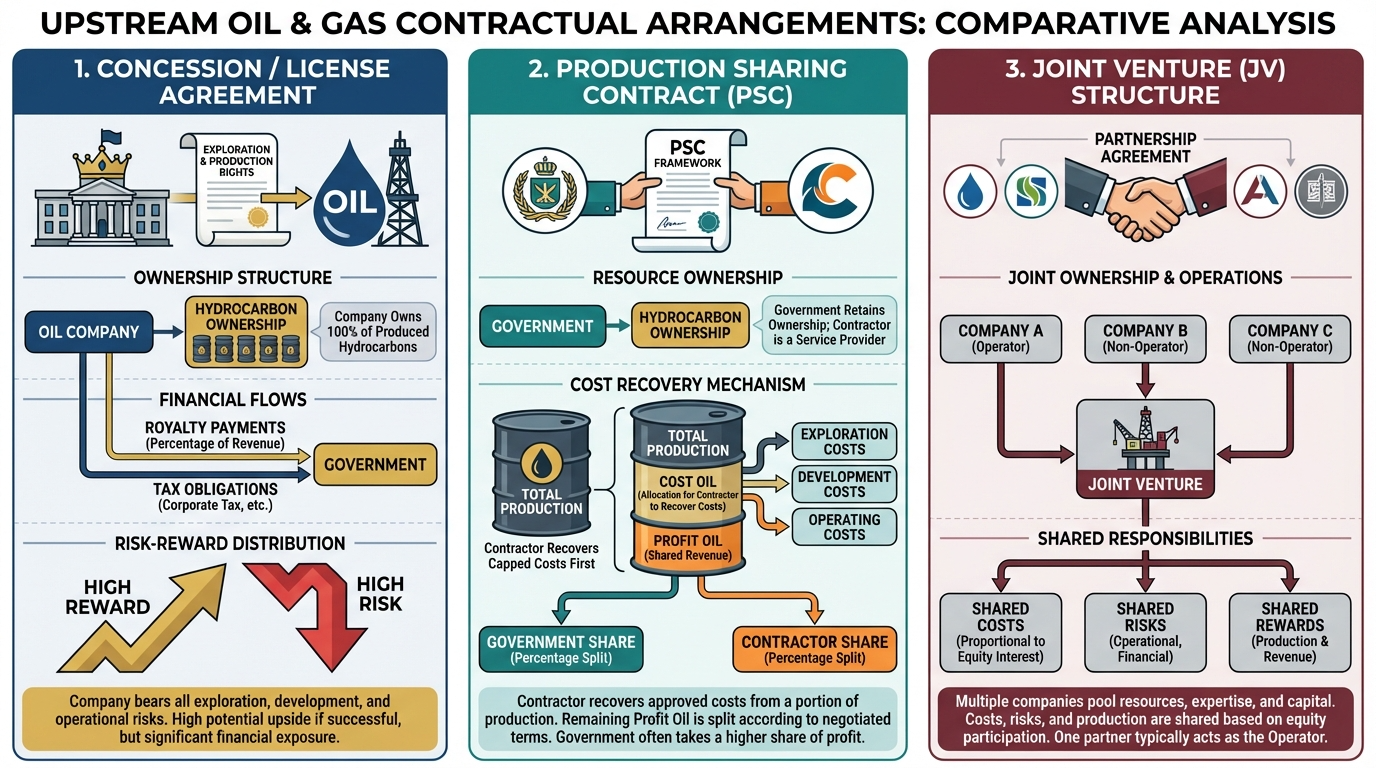

Module 1.1: Introduction to Upstream Contracts

Petroleum contract role in upstream operations

Historical evolution: from old concessions to modern agreements

Sovereignty over natural resources principles

Host government objectives and investor requirements

Risk allocation between parties

Contract types overview and selection criteria

Regional contractual frameworks: Middle East vs. Africa

International legal principles and best practices

Module 1.2: Key Contractual Elements

Contract area definition and coordinates

Contract duration and extension provisions

Work program and minimum expenditure commitments

Exploration, development, and production phases

Relinquishment obligations and area reduction

Ring-fencing provisions

Termination rights and force majeure

Dispute resolution mechanisms

Afternoon Session: Concession Agreements

Module 1.3: Concession System Fundamentals

Traditional concession agreement structure

License and lease systems

Ownership of petroleum in-place and produced

Exclusive rights and obligations

Royalty and tax-based fiscal terms

Bonuses: signature, discovery, production

Decommissioning and abandonment obligations

North African concession examples: Egypt, Algeria, Libya

Module 1.4: Modern Concession Frameworks

Progressive royalty structures

Sliding scale tax regimes

Resource rent tax mechanisms

Profit-based royalties

Cost recovery allowances in hybrid systems

State participation options

Local content requirements integration

GCC licensing rounds and bidding parameters

Day 2: Production Sharing Contracts

Morning Session: PSC Architecture

Module 2.1: PSC Fundamentals

Production sharing philosophy and principles

Government ownership vs. contractor rights

PSC vs. concession comparison

Cost recovery mechanisms: limits and procedures

Profit oil/gas splitting formulas

Contractor entitlement calculation

Production bonuses and R-factor systems

Investment credit mechanisms

Module 2.2: Cost Recovery and Petroleum Costs

Recoverable vs. non-recoverable costs

Capital expenditure (CAPEX) recovery

Operating expenditure (OPEX) recovery

Cost pools and allocation methods

Cost recovery ceilings and limitations

Depreciation and amortization schedules

Abandonment cost recovery

Audit rights and cost verification procedures

Afternoon Session: Profit Sharing and Fiscal Terms

Module 2.3: Profit Oil/Gas Mechanisms

Fixed split vs. variable split formulas

Production-based sliding scales

R-factor (cumulative revenue/cost) systems

Rate of return-based sharing

Price-responsive sharing mechanisms

Gas vs. oil profit sharing differences

Domestic market obligation (DMO) pricing

Indonesian, Malaysian, and African PSC models

Module 2.4: Taxation in PSCs

Income tax provisions in PSCs

Tax paid by government vs. contractor

Withholding taxes on services

Indirect taxes: VAT, import duties

Tax consolidation and ring-fencing

Thin capitalization rules

Transfer pricing considerations

Double taxation treaties

Oman PSC fiscal framework

Day 3: Joint Venture Agreements and JOAs

Morning Session: Joint Venture Structures

Module 3.1: Joint Venture Fundamentals

Incorporated vs. unincorporated joint ventures

Equity joint ventures vs. contractual JVs

Consortium arrangements

Participating interests and working interests

Carried interest provisions

Farm-in and farm-out agreements

Sole risk and non-consent operations

Government participation mechanisms

Module 3.2: Operator Selection and Responsibilities

Operator appointment and removal

Operatorship criteria and qualifications

Operator duties and standard of care

Prudent oilfield practices

Technical and administrative responsibilities

Exclusive operations vs. joint operations

Operator liability and indemnification

Performance metrics and KPIs

Afternoon Session: Joint Operating Agreements

Module 3.3: JOA Structure and Key Provisions

AIPN Model JOA overview

Operating committee composition and authority

Voting rights and decision-making thresholds

Annual work programs and budgets (AFE)

Cash calls and funding procedures

Default provisions and remedies

Withdrawal and abandonment rights

Confidentiality and data ownership

Module 3.4: Financial and Accounting Procedures

Joint account structure

Charging principles and cost allocation

Direct vs. indirect costs

Overhead and administrative charges

Material and equipment procurement

Lifting and marketing of production

Production imbalances and balancing

Audit rights and procedures

COPAS accounting standards

Day 4: Commercial Terms and Negotiation

Morning Session: Fiscal Design and Economics

Module 4.1: Fiscal System Design

Government take vs. contractor take

Progressive vs. regressive fiscal terms

Fiscal stability and neutrality

Investment attractiveness metrics

Economic modeling and sensitivity analysis

Breakeven analysis under different fiscal terms

Marginal field fiscal incentives

Deepwater and HPHT fiscal concessions

Module 4.2: Bonuses and Financial Commitments

Signature bonuses: timing and amount

Discovery bonuses and thresholds

Production milestone bonuses

Commercial discovery declarations

Minimum work program commitments

Bank guarantees and performance bonds

Financial capacity requirements

Abandonment fund contributions

Afternoon Session: Contract Negotiation

Module 4.3: Negotiation Strategy and Tactics

Pre-bid analysis and due diligence

Bid strategy development

BATNA (Best Alternative to Negotiated Agreement)

Win-win negotiation approaches

Government vs. IOC/NOC perspectives

Negotiation team composition

Red lines and negotiable terms

Cultural considerations in Middle East and Africa

Module 4.4: Local Content and Social Obligations

Local content definitions and requirements

Goods and services procurement obligations

Employment and training commitments

Technology transfer provisions

In-Country Value (ICV) programs: Oman, UAE

Nigerian Content Development Act

Angola’s Angolanization requirements

Community development obligations

Compliance monitoring and penalties

Day 5: Risk Management and Special Topics

Morning Session: Risk Allocation and Management

Module 5.1: Contractual Risk Management

Geological and technical risk allocation

Commercial and price risk management

Political risk and stabilization clauses

Force majeure provisions and interpretation

Environmental liability allocation

Third-party claims and indemnification

Insurance requirements

Change in law and economic equilibrium clauses

Module 5.2: Decommissioning and Abandonment

Abandonment obligations and standards

Cost estimation and funding mechanisms

Abandonment security and guarantees

Asset retirement obligations (ARO)

Technology for cost reduction

Regional regulatory requirements

Transfer of abandonment liability

North Sea lessons for Middle East and Africa

Afternoon Session: Dispute Resolution and Special Contracts

Module 5.3: Dispute Resolution Mechanisms

Negotiation and expert determination

Mediation and conciliation

Arbitration: institutional vs. ad hoc

ICSID, ICC, LCIA arbitration rules

Applicable law and seat of arbitration

Enforcement of arbitral awards

Sovereign immunity considerations

Recent petroleum arbitration cases

Module 5.4: Special Contract Types

Service Contracts:

Risk service contracts: Iraq model

Technical service agreements (TSAs)

Pure service contracts vs. PSCs

Fee structures: fixed, per barrel, incentive-based

Remuneration mechanisms

Gas Contracts:

Gas sales agreements (GSAs)

Take-or-pay provisions

Price review and arbitration

LNG SPAs and pricing mechanisms

Domestic gas supply obligations

Unitization and Redetermination:

Cross-border reservoir management

Unit operating agreements

Redetermination of participating interests

GCC cross-border field examples

Case Studies and Practical Workshop

Regional Contract Analysis:

Saudi Arabia:

Saudi Aramco partnership models

Unconventional gas concessions

Joint venture structures with IOCs

Jafurah gas development agreements

Oman:

PDO concession agreement structure

Block PSC framework and variations

Exploration and production sharing terms

ICV requirements in contracts

UAE:

ADNOC offshore concession model

40-year concession extensions

Onshore license terms

Abu Dhabi competitive bidding framework

Kuwait:

Project Kuwait technical service agreements

Operating service agreements structure

Enhanced technical service agreements (ETSAs)

Qatar:

North Field partnership agreements

LNG joint ventures

Offshore concession framework

Africa:

Nigeria PSC and JOA structures: NNPC partnerships

Angola PSC evolution and local content

Egypt concession and PSC models

Ghana petroleum agreements

Mozambique LNG project contracts

Senegal/Mauritania cross-border cooperation

Interactive Workshop:

Contract drafting exercise

PSC economic modeling

JOA voting rights simulation

Negotiation role-play scenarios

Dispute resolution case analysis

Local content compliance planning

Red flag identification in contracts

Term sheet development

Group presentations and feedback

Learning Outcomes

Participants will gain:

Comprehensive understanding of concession and PSC structures

JOA expertise including operation and governance

Negotiation skills for petroleum agreements

Fiscal analysis capabilities for different contract types

Risk management knowledge for contractual issues

Regional expertise in KSA, Oman, GCC, and African frameworks

Drafting proficiency for key contractual clauses

Dispute resolution awareness and strategies

Regional Contract Focus

Saudi Arabia: Aramco partnership models, unconventional concessions, joint venture frameworks

Oman: Block PSC system, ICV integration, mature field contracts, PDO operating model

GCC: ADNOC concessions, Qatar partnerships, Kuwait service agreements, competitive licensing

Africa: Nigerian PSCs, Angolan local content, Egyptian licensing, cross-border unitization

Training Methodology

Expert-led contract analysis sessions

Template contracts and model agreements review

Interactive negotiation simulations

Case law and arbitration review

Economic modeling workshops

Drafting exercises

Regional contract comparison

Guest speakers from legal and commercial teams

Duration: 5 days (40 hours)

Delivery: In-person preferred, hybrid available

Language: English (Arabic support available)

Materials: Sample contracts, templates, fiscal models

Certification: Professional petroleum contracts certificate

Keywords: petroleum contracts training, PSC course KSA, concession agreements Oman, JOA training GCC, production sharing Africa, joint venture oil gas, upstream contracts Middle East, Saudi Aramco partnerships, ADNOC concessions, PDO PSC, fiscal terms negotiation, petroleum legal framework, IOC NOC agreements, contract negotiation upstream